What is APBOE®?

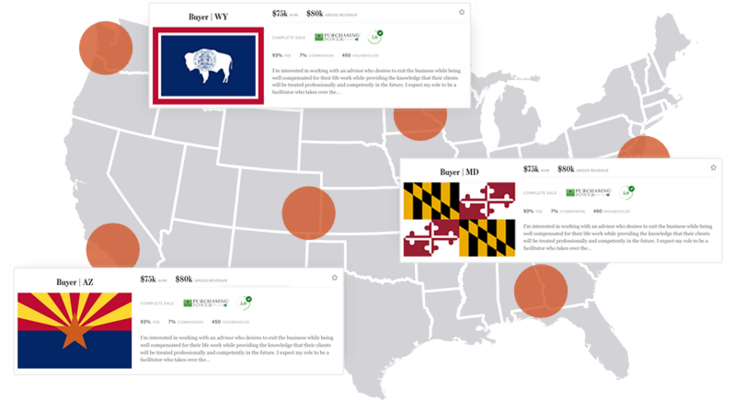

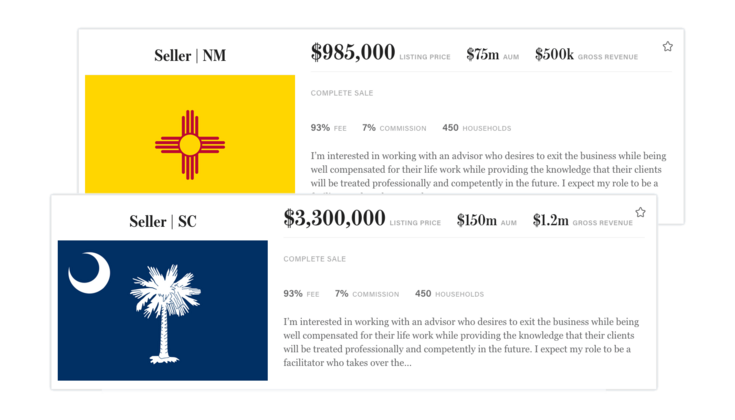

The Advisory Practice Board of Exchange (APBOE®) is a financial advisor marketplace to buy and sell wealth management practices. APBOE® is a neutral site for multiple third-party valuation providers, M&A consultants, investment banks, and independent broker dealers to list sellers, search buyers, and ultimately sell practices.

APBOE® provides access to bank financing to fund wealth management practices. Via our Pre-Approval portal, applicants are routed to an independent Lender Marketplace to find the best bank partner to fund your transaction. APBOE® provides a turnkey solution for independent and registered investment advisors to buy and sell wealth management practices with the requisite funding.

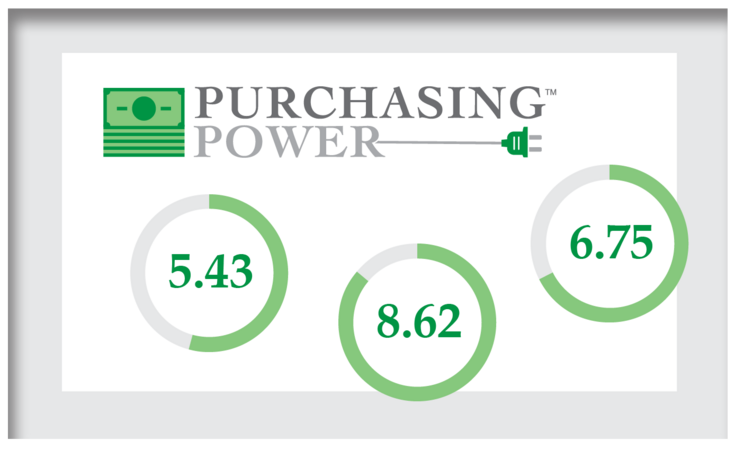

Sellers on APBOE® can ascertain creditworthiness and practice readiness of prospective buyers from our proprietary PurchasingPower™ scoring methodology. Buyers on APBOE® can increase their likelihood of acquiring practices by receiving a verified PurchasingPower™ score.

Seller Benefits

At APBOE®, we not only pair buyers with sellers, but our team also prequalifies your practice for

financing available from one of our partner banks. Sellers enjoy several APBOE® attributes:

- Complete anonymity and data security

- Buyers are unable to contact sellers

- After reviewing prospective buyers, sellers control the communication by contacting buyers

- Access to PurchasingPower™ score of interested buyers providing an efficient screening

process

- M&A consultant representation to ensure most attractive listing prices, promote a

seamless transaction and create deal structure that is eligible for bank financing

- Bank financing analysis to determine the amount of financing a seller’s practice qualifies

for prior to setting a list price

- Bank financing options from our national network of lenders in our Lender Marketplace to

provide customized solutions to meet an individualized retirement glidepath

Buyer Benefits

APBOE® is a comprehensive platform for serious practices acquirers. Buyers benefit from a number of our platform’s features:

- No subscription fees for standard buyers

- Seller search functionality that provides clear results on verified opportunities

- All seller listings are verified by APBOE® and their respective M&A consultant

- Buyers can increase their probability to buy a practice by increasing their PurchasingPower™ score

- Updates on your Bookmarked Practices to give you insight into the progress of a seller listing

- Access to conventional and SBA lenders for up to 95% of the purchase price

- Buyers who qualify for an ABPOE designation appreciate enhanced benefits

PurchasingPower™ Rating

Each buyer is assigned a PurchasingPower™ rating based on their ability to acquire practices. Some key factors that determine PurchasingPower™ rating include:

- Completion of My Practice Profile

- Completion of current valuation from a verified valuation provider

- Banking relationship with a bank who funds advisory loans

- Liquidity for down payment

- Scores are verified after submitting all documents under the Verification tab

- Gross Revenue Report OR Previous Year & YTD P&L

- Model Investment Portfolio

3.3 x

3.3 x