DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x

DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x DCOM

DCOM FLSE

3.11 x

FLSE

3.11 x

3.3 x

3.3 x

What’s your PurchasingPower™?

PurchasingPower™ is a scoring methodology that gauges the credit worthiness and readiness of a buyer’s ability to acquire another wealth management practice.

Industry publications state there are 50 buyers for every seller in the financial services industry, but we find that not to be the case. Rather, only 4 to 5 buyers for every seller complete the necessary work to acquire. Ultimately, PurchasingPower™ scores provide sellers with increased transparency into a potential buyer's ability to purchase another practice by analyzing over 30 data points.

Some key factors that determine your PurchasingPower™ score:

- Completion of My Practice Profile

- Completion of current valuation from a verified valuation provider

- Banking relationship with a bank who funds advisory loans

- Liquidity for down payment

- Verification from documentation, including:

- Gross Revenue Report

- Valuation

- Model Investment Portfolio

National Leaderboard

National financial advisor ranking of creditworthiness and readiness to purchase another practice.

- JTL Wealth partners, TXStandard 9.4

- Coastal Wealth Management, CTStandard 9.37

- Montis Financial, MANextLevel™ 9.35

- Liberty Bell Financial Group, CAStandard 9.32

- Wilde Wealth Management Group, AZNextLevel™ 9.16

- AWAIM®, CAStandard 9.14

- Epic Private Wealth, WAStandard 9.08

- Atlas, NJNextLevel™ 9.01

- Diversified, LLC, DEStandard 8.92

- Tomren Wealth Management, CAStandard 8.75

FAQs: PurchasingPower™

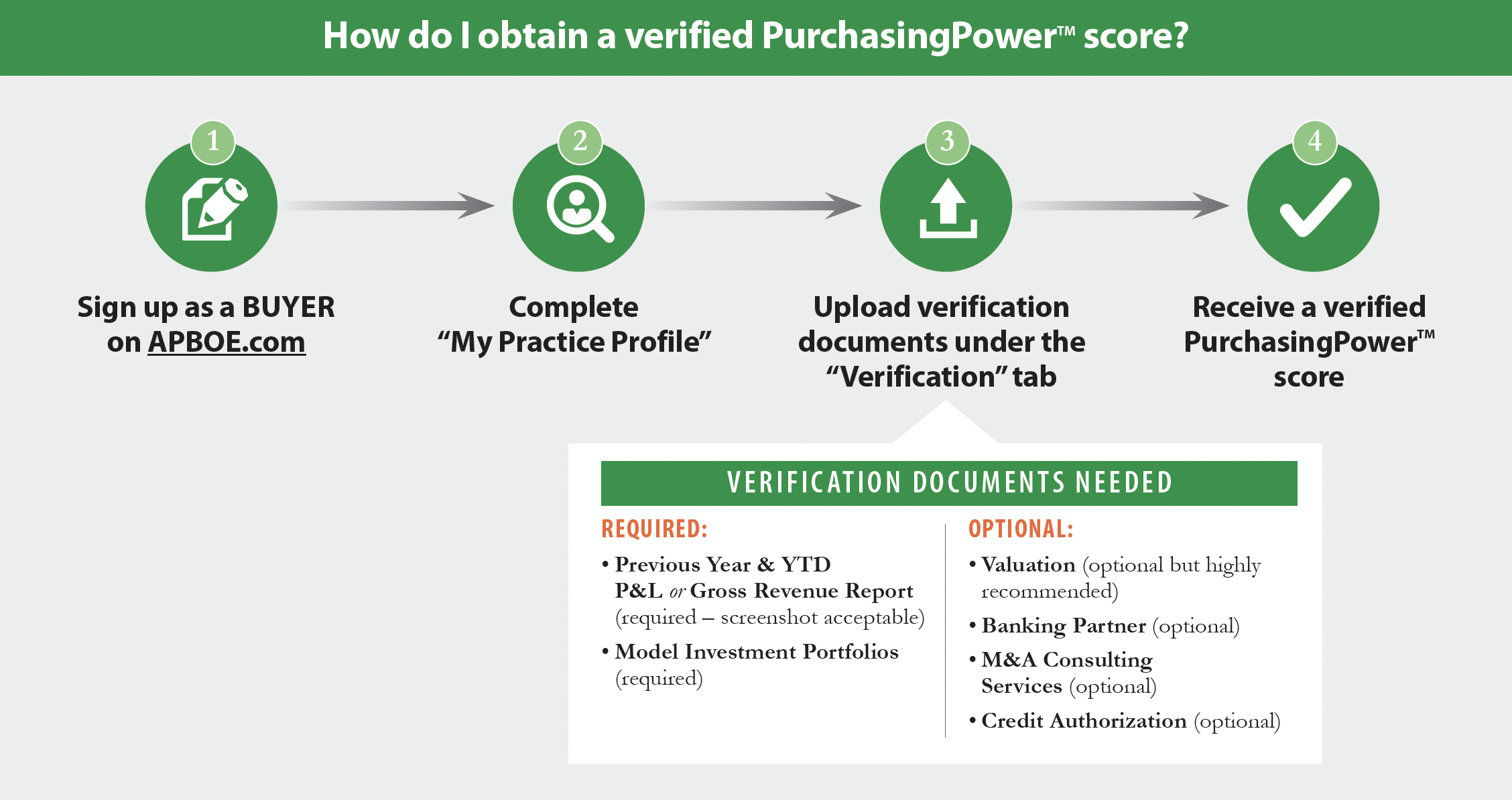

Prospective buyers who complete the PurchasingPower™ verification process are assigned a rating from 1 to 10. Verified PurchasingPower™ scores are provided to buyers after all required documents have been uploaded.

How is the PurchasingPower™ score calculated?

The algorithm for generating a PurchasingPower™ score was developed by seasoned credit and investment banking analysts. There are over 30 factors that determine the score and are gathered during the verification process.

Why would I get a PurchasingPower™ score?

Verified PurchasingPower™ scores are obtained by financial advisors interested in acquiring a financial advisory practice. PurchasingPower™ ratings allow sellers to select the most appropriate buyer to purchase their financial advisor practice. In addition, PurchasingPower™ scores can be utilized to market yourself to prospective sellers in your area.

How are the PurchasingPower™ scores utilized?

APBOE provides PurchasingPower™ scores to sellers and their M&A consultants to determine the creditworthiness and readiness of the buyer to purchase a practice.

How can I obtain the highest PurchasingPower™ score?

Each factor in determining PurchasingPower™ has a different weighting. For more information on how to improve your current score, please call our APBOE Buyer Representatives at (800) 263-4908.

What documents are required for PurchasingPower™ score verification?

- Gross Revenue Report (screenshot acceptable)

- Model Investment Portfolios

- Valuation (optional but highly recommended)

- M&A Consulting Services (optional)

- Credit Authorization (optional)

For assistance in the verification process and uploading documents, please call our APBOE Buyer Representatives at (800) 263-4908.

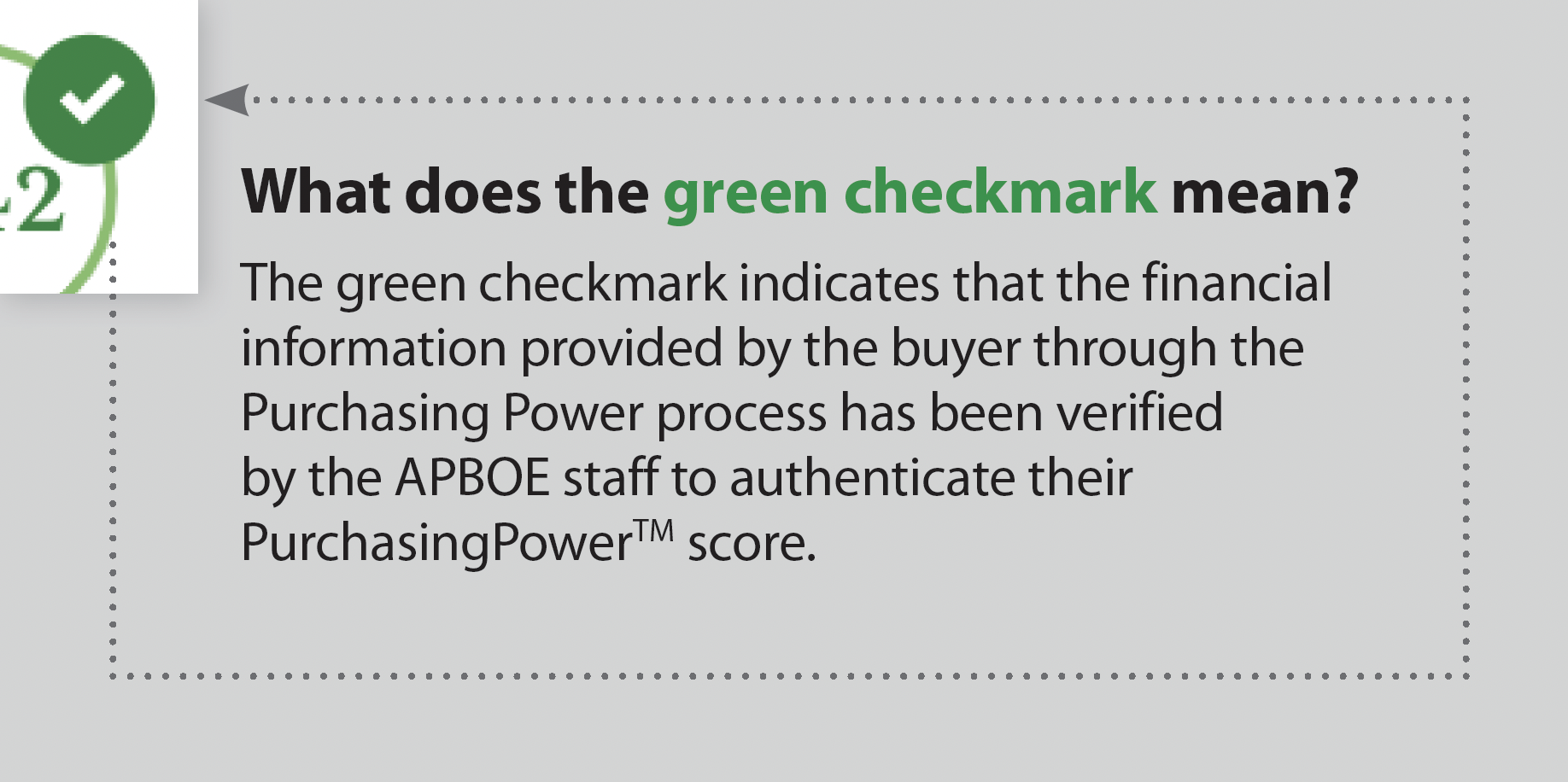

What does a verified PurchasingPower™ score mean?

A verified PurchasingPower score indicates to sellers that the buyer has provided financial information to the APBOE staff to substantiate data utilized to generate their PurchasingPower score.

Buyer Designations

Buyers who receive the Xccelerate™ or NextLevel™ designation do not receive higher PurchasingPower™ scores. Designees receive exclusive and advanced access to seller listings in addition to additional buyer functionality.